Growth upwards

The precious metal managed to partially recover its losses, rising to 3,118 USD by April 10, 2025. The growth followed a drop below the psychological level of 3,000 USD, with its price reaching a historic high of approximately 3,150 USD in the first two days of April. The same trend was observed with gold futures contracts for delivery in June 2025. After a previous decline, their price increased to 3,132 USD by the same date. Despite the drops, gold was up 17% since January 2025. Over the past year, its price increased by 33%, and over the last 5 years, it has risen by as much as 80%. *

Source: Investing.com*

Source: Investing.com*

Tension supported gold

The slow return of gold to its highs was supported by demand for a safe haven, as tensions between the two largest superpowers escalate. A new 84% tariff on American goods heading to China was introduced by Beijing after Donald Trump announced another round of import measures on April 2, 2025. These measures were supposed to take effect on April 9, 2025, but just hours after they went into effect, Trump announced a 90-day delay, which did not apply to China. In the case of the Asian country, its president raised the tariff to 125%. "Liberation Day," as April 2 was called, involved a 10% tariff on all imported goods, with higher rates for dozens of countries, including a 20% tariff on the European Union. The market immediately reacted with massive sell-offs, which also affected gold, with investors using it to cover losses on other assets.

Highest levels of ETFs

Questions and uncertainty surrounding the trade decisions of the White House led investors to shift investments into gold-backed ETFs in the first quarter. According to the World Gold Council, this amounted to 21.1 billion USD, the highest level since the start of the coronavirus pandemic. In terms of weight, 226.5 tons of gold were invested in ETFs. For comparison, more gold was invested in 2022 when the war in Ukraine began, with inflows exceeding 270 tons.

Copper also went through a correction

The copper market also recorded sell-offs, with contracts on the Comex exchange in New York falling below the 5 USD per pound (0.45 kg) level on April 2, 2025, extending losses to 4.20 USD in the following days. The historic high was reached just a few days earlier, on March 26, 2025, at 5.30 USD. By April 10, 2025, the price slightly rose to 4.44 USD. Despite the decline, copper managed to maintain a high level, with more than a 10% increase since the beginning of the year. In terms of annual performance, futures showed a 3% increase, and over the past 5 years, their price rose by more than 93%. *

Source: TradingView.com*

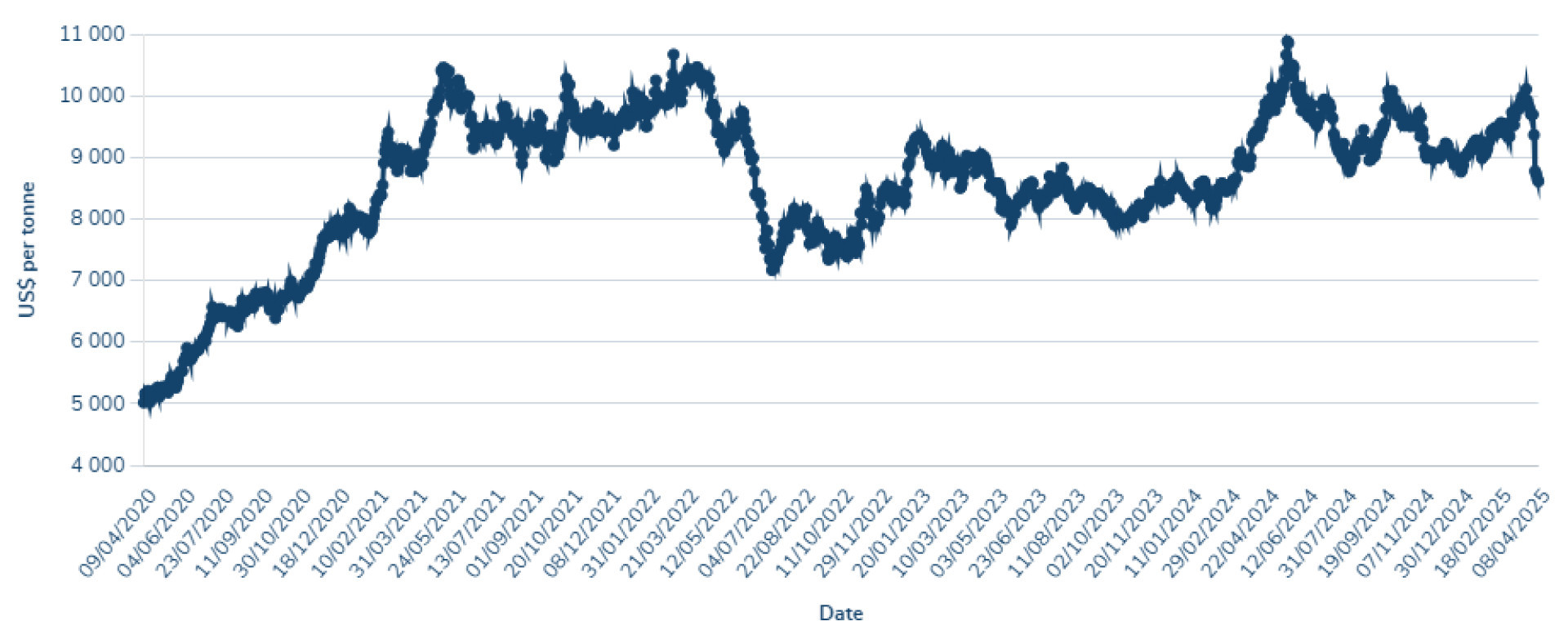

A similar situation occurred on the London Metal Exchange (LME), where the price of 3-month futures fell to 8,613 USD per ton by April 10, 2025, which was approximately their yearly minimum. Their value began to decline on March 25, 2025, when it retreated from the psychological level of 10,000 USD, due to capital moving to the U.S. market amid concerns over tariffs. Interestingly, the March movements on the LME and Comex exchanges were completely different, which is a rare situation since both usually mirror each other's movements. This suggests how significantly tariffs can impact regular trading. The current declines have caused contracts to lose 1.7% in value since the beginning of the year, while over the past year, the loss was 8%. A more positive outlook is seen in the 5-year performance, where the price increased by 71%. *

Source: London Metal Exchange*

Pressure on copper continues

Although Trump's April announcement did not include copper and tariff increases on steel and aluminum, investors were concerned that they would have a significant impact on global demand for metals. However, this does not mean that tariffs could not eventually apply to the red metal. In February, federal officials were tasked by the president with investigating copper imports within 270 days, assessing their impact on U.S. security, which, according to Bloomberg, may be completed in a much shorter time. This information also supports previous statements from White House trade advisor Peter Navarro, who said that Secretary of Commerce Howard Lutnik would work quickly to deliver results as soon as possible. The same task was given to officials during Trump's first term, but back then, the entire process took up to 10 months before tariffs were imposed.

Conclusion

The aggressive increase in tariffs between the U.S. and China has significantly impacted the commodity markets. The shift in capital to salvage other assets highlights that even gold, which is considered a safe haven in times of turmoil, can face sharp declines. Therefore, it is important to be cautious when trading and not rely on established rules. A retreat from record levels, however, may present an interesting opportunity to enter positions.

* Past performance is not indicative of future results.

Disclaimer! This marketing material is not, and should not be considered, as investment advice. Past performance is not indicative of future results. Investing in foreign currencies may affect returns due to fluctuations. All securities transactions may result in both profits and losses. Forward-looking statements represent assumptions and current expectations that may not be accurate, or based on the current economic environment, which can change. These statements do not guarantee future performance. InvestingFox is a trademark of CAPITAL MARKETS, o.c.p., a.s., regulated by the National Bank of Slovakia.

Sources:

https://www.bbc.com/news/articles/c5y66qe404po

https://www.mining.com/copper-price-slumps-into-bear-market-amid-tariff-fears/

English

English

Slovak

Slovak

Czech

Czech

Hungarian

Hungarian

Italian

Italian

Polish

Polish

.jpg)