Slow growth and profit decline

Mondelez reported a 3.1% growth in organic net revenues for the first quarter of 2025 compared to the previous year, totalling more than $9.31 billion. Despite being a 0.2% increase, it was lower than the $9.33 billion estimated by LSEG analysts. The company managed to generate cash flow of $800 million, while paying more than $2 billion to its shareholders through dividends and share buybacks. The negative aspect was a significant drop in profit, with earnings per share suffering. Gross profit fell to $2.43 billion, representing a nearly 49% year-on-year decline, while the gross margin decreased from 51% to 26%. Diluted earnings per share (EPS) plummeted by 70% to $0.31, while adjusted EPS for the period was $0.74, a decrease of 18%.

Price increase as compensation

Although in some cases the changes were quite significant downward, the manufacturer managed to partly mitigate them through lower advertising costs and the integration of acquisitions, ending programs from previous periods, but mainly with higher product prices. Consumers have been paying more for Mondelez's sweets for a while now. For example, the price of Toblerone chocolates, according to Investing.com, increased by 6.6 percentage points in the first three months. Higher prices, however, compensated for the decline in sales volume, which for Toblerone dropped by 3.5 percentage points. Currency exchange rate changes, the implementation of a new resource planning program, and notably high commodity prices still had an impact. Trade tariffs, which would cause American consumers to pay more for chocolate products, also create uncertainty around profit margins.

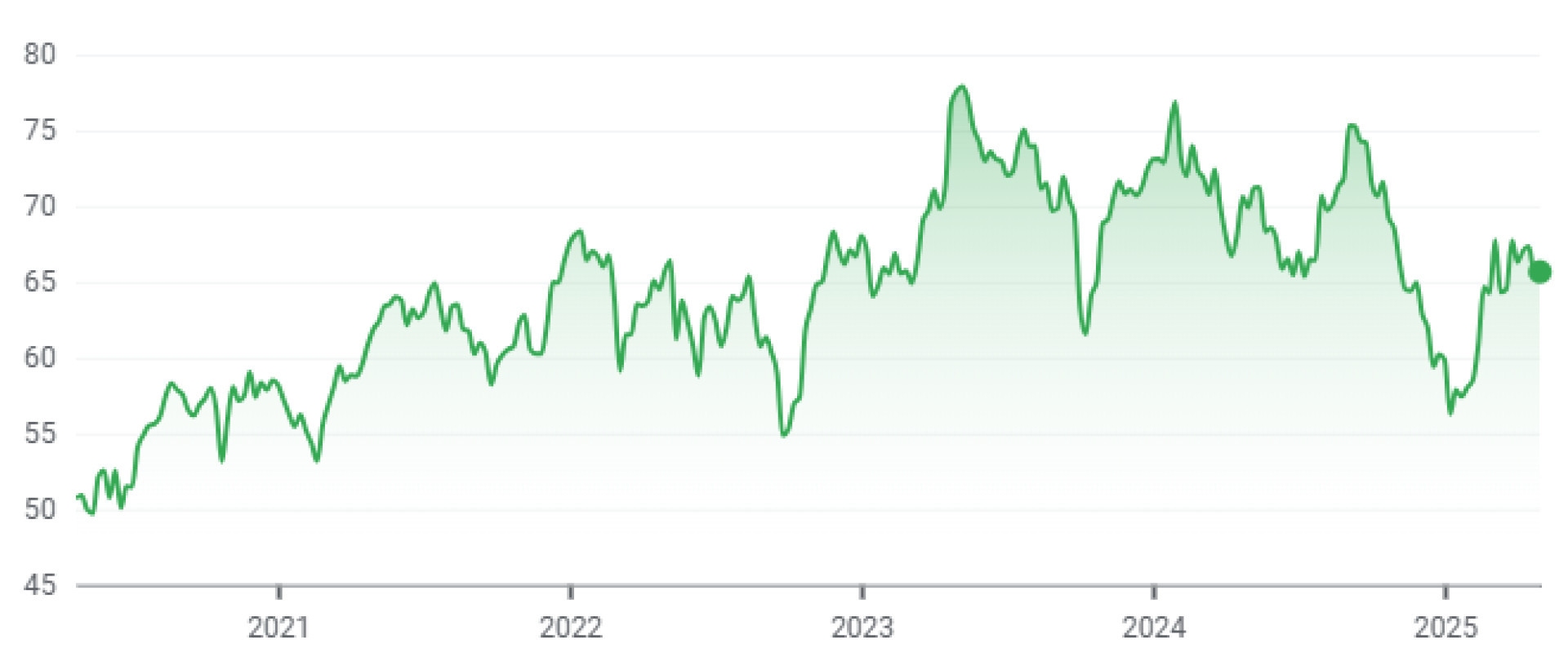

Record Year for Cocoa

The main ingredient of chocolate, cocoa, saw a sharp increase last year, with the price of spot contracts on the ICE exchange rising from $4,200 per ton to a historic high of more than $11,460 in April, and later surpassing this record in mid-December, reaching $12,000.* Contracts have been on a declining trend this year, with a 27% loss, and as of April 30, 2025, were valued at $8,420.*

Source: Trading View*

Mixed Outlook

It is important to note that manufacturers like Mondelez purchase raw materials in advance, so the current market declines do not yet have significant weight. However, the company expects that the pressure from high cocoa prices will remain strong this year. Projections suggest that its organic net revenues will increase by about 5%, but EPS will decline by another 10%.[1] Mondelez anticipates continued volatility due to global uncertainty, and its outlook does not include changes in customs policies, which could lead to further changes in future forecasts.

Stock Market Performance

As for stock performance, Mondelez shares were up about 2% before the market opened on April 30, 2025, thanks to its financial results. Since the beginning of the year, they have gained 10.3%, but their annual performance has fallen by more than 8%. Over a 5-year period, the stock value was up by 29.5%.*

Source: Google Finance*

Conclusion

The results from the chocolate manufacturer suggest a period full of challenges that will likely continue. For now, Mondelez is managing to compensate for the situation by raising prices, but it remains uncertain how long such steps will be sustainable, as sales volumes are already declining. However, the company's performance on the stock market suggests that the market believes in the company’s future potential.

* Past performance data is not a guarantee of future returns.

[1] Forward-looking statements represent assumptions and current expectations, which may not be accurate, or are based on the current economic environment, which may change. These statements do not guarantee future performance. By their nature, forward-looking statements involve risk and uncertainty, as they relate to future events and circumstances that cannot be predicted, and actual developments and results may differ significantly from those expressed or implied in any forward-looking statements.

Warning! This marketing material is not and should not be construed as investment advice. Past performance data is not a guarantee of future returns. Investing in foreign currency may affect returns due to fluctuations. All securities transactions can lead to both profits and losses. Forward-looking statements represent assumptions and current expectations, which may not be accurate, or are based on the current economic environment, which may change. These statements do not guarantee future performance. InvestingFox is a trademark of CAPITAL MARKETS, o.c.p., a.s., regulated by the National Bank of Slovakia.

Sources:

https://ir.mondelezinternational.com/static-files/c6b7675d-a832-4198-90dd-60d3069ee2d4

English

English

Slovak

Slovak

Czech

Czech

Hungarian

Hungarian

Italian

Italian

Polish

Polish